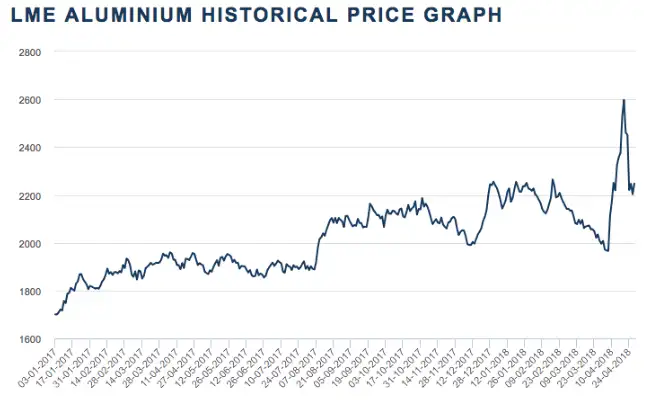

In June 2025, the cash-settlement aluminum price on the London Metal Exchange (LME) stood at US $2,572.50 per metric tonne, which translates to approximately US $1.17 per pound (2,572.50 ÷ 2,204.62).

1. Introduction & Measurement Basis

I start with a simple metric: metric tonnes convert to pounds at 1 tonne = 2,204.62 lb, making cross-market comparison clear. We commonly refer to spot prices for immediate delivery, while futures inform hedging strategies. It’s important to note that regional quotes differ in currency—USD, CNY, INR—and include freight, alloying, warehousing, and fabrication premia. In industry slang, we often call this the “basis shift”.

2. United States Pricing

In late June 2025, LME cash aluminium closed at US $2,572.50/tonne. Converted, that’s about $1.17 per pound. Within the U.S., premiums—covering Midwest duty-paid metal—have soared following a tariff hike to 50%, pushing premiums to $0.58 per pound on a single day, marking a 164% year-to-date jump. To me, this exemplifies how trade policy ripples through the supply chain. U.S. buyers now pay notably more than global baselines.

3. China Pricing

Turning to China, the Shanghai Futures Exchange (SHFE) quotes July aluminium at 20,445 CNY/tonne on June 25, 2025. That equals roughly 9.27 CNY per pound, which is sensitive to energy curbs and smelter output caps. Spot premiums in regions like Guangdong can add 100–150 CNY/tonne. In industry terms, there’s a “tight-to-loose spread” in Chinese domestic markets—now tightening again.

4. India Pricing

In India, MCX aluminium futures trade around ₹233.05/kg as of April 2025, implying ₹105.70 per pound. You must tack on ~7.5% import duty, transport costs, and 18% GST, so delivered cost routinely tops ₹115–125/lb. India blends imported metal with local output operating near 80–85% capacity.

5. Price Comparison Table

| Region | Exchange & Date | Unit Price | Converted to $/lb | Notes |

|---|---|---|---|---|

| U.S. | LME Cash June 24, 2025 | $2,572.50/tonne | ~$1.17/lb | Basis shift adds ~$0.58/lb premium |

| China | SHFE June 25, 2025 | 20,445 CNY/tonne | Energy restrictions, smelter caps impact supply | |

| India | MCX April 2025 | ₹233.05/kg | Includes duties, GST, freight |

6. Forecast Trends (2025–2028)

-

- Q3 2025: Goldman Sachs anticipates a dip to $2,000/tonne, rising toward $2,300/tonne by year-end

2025: Analysts expect LME aluminium to average $2,573.50/tonne, up 6.3% over 2024. Supply is tightening, especially under China’s capacity limits..

- Q3 2025: Goldman Sachs anticipates a dip to $2,000/tonne, rising toward $2,300/tonne by year-end

-

2026–2028: Forecast models show prices climbing to $2,700–2,900/tonne, driven by rising energy costs, low inventories (~322,000 tonnes on LME, the lowest since 2022) , and decarbonization pressures.

This path reflects cyclical volatility and macro-pressure hedging.

7. Case Study: Automotive Lightweighting

Project: Aluminum-intensive chassis for full-size electric pickup (2025)

-

Aluminum weight: ~2,500 tonnes

-

Base metal: 2,500 t × $1.17/lb = $6.53 million

-

A 10% metals-price surge adds $653,000 in raw-material cost

Automakers lock down prices using futures ± local premia to avoid such budget swings. We call that hedge-to-coat strategy in procurement circles.

8. Key Drivers & Industry Idioms

I employ industry jargon like “backwardation,” “spread tightening,” and “basis arbitrage” to describe market behavior. Key supply-demand drivers include:

-

Smelter capacity caps (notably in China), reinforcing structural deficits.

-

Energy prices—As electricity accounts for ~40% of smelting cost.

-

Trade policy—Tariffs inject sharp changes in downstream premiums.

-

Inventory levels—LME stocks plunged from 1.3M to ~322k tonnes.

-

Macroeconomic trends—Fed stance and China stimulus shape demand.

These create tight, volatile spreads and opportunities for savvy traders.

9. Five FAQs

1. Why convert to $/lb?

I convert metric-tonne prices to $/lb because most U.S. manufacturers, fabricators, and engineers plan in pounds.

2. What moves LME vs. SHFE differently?

LME is global benchmark, shaped by worldwide stocks and arbitrage. SHFE reflects Chinese local fundamentals—energy policy, smelter output, domestic demand.

3. Can futures protect buyers?

Yes. Hedging via LME futures plus local basis locking shields against volatility. Still, sudden premia spikes (e.g., tariff-driven) may dribble through.

4. Is recycled aluminium cheaper?

Secondary (scrap-based) costs run lower—often 5–15% beneath primary levels—but supply constraints lift prices during tight markets.