As of late June 2025, aluminum scrap in the United States averages $1,973 per metric ton (≈ $0.90/lb); in China domestic shredded scrap trades near CNY 324.15/t; and in India, common utensil scrap sells around ₹247,000 per ton.

1. Global Market Overview

I’ve tracked scrap markets for two decades. The sector isn’t static. Demand from automotive die‐casters, beverage can recyclers, and construction foundries drives pricing. Often, market sentiment lags—but not always. For instance, after President Trump doubled U.S. aluminum tariffs to 50%, domestic premiums spiked to a record 62.5¢/lb. Those dynamics ripple through global scrap flows.

· Short supply in Europe.

· China’s import quotas.

· India’s booming secondary‐smelter capacity.

Prices fluctuate daily. Yet, broad trends are clear: secondary aluminum is in vogue, down and dirty costs are rising, and the value‐added recyclers command premium margins.

2. Determinants of Aluminum Scrap Price

Understanding scrap pricing requires a “bottom‐up” view. Several factors play pivotal roles:

-

Metal Grade & Alloy Content

– UBC (Used Beverage Cans) fetch higher bids.

– Mixed turnings lean lower. -

Local Supply‐Demand Balance

– Regional yard availability can swing prices ± 10%. -

Energy & Processing Costs

– Electricity rates in China versus the U.S. differ significantly. -

Logistics & Transportation

– Freight to ports matters—particularly for CFR‐based pricing. -

Policy & Tariffs

– Import duties reshape net‐back values.

Some may wonder: how much does quality matter? Very. Premiums on 99%-pure aluminum ingots can exceed scrap by 20–30%.

3. Price Comparison: USA, China, India

I lay out a concise table for quick reference. Notice units differ by region—but conversion is straightforward.

| Country | Sample Category | Price | Unit |

|---|---|---|---|

| USA | Mixed Aluminum Turnings | $0.50 | USD per lb |

| China | UBC (Used Beverage Cans) | CNY 12,600 | CNY per MT |

| India | Aluminum utensil scrap | ₹247,000 | Rupee per Ton |

Note: 1 MT ≈ 2,204.62 lb; 1 Ton (India) ≈ 1,000 kg.

Those numbers capture prevailing levels in June 2025. Of course, local yards may vary ± 5%.

4. Industry Standards & Technical Specifications

I reference key authoritative criteria that define scrap grades:

-

ISO 9001-compliant sorting for secondary aluminum.

-

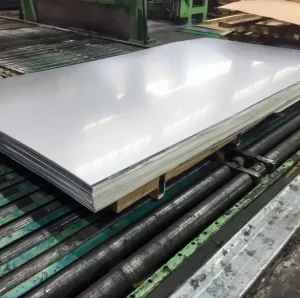

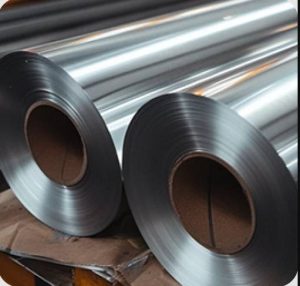

ASTM B209 for aluminum plate, sheet, and strip alloys (relevant for blade turnings).

-

DIN EN 573-3 specifies chemical composition tolerances.

-

RoHS & REACH restrictions on lead and mercury in scrap.

These benchmarks ensure uniform quality—and protect downstream smelters from contamination. Moreover, cutting-edge spectrometers verify alloy codes, reducing re-melting rejects.

5. Impact of Trade Policies & Tariffs

Policy can make—or break—margins. Consider:

-

U.S. Tariffs: 50% on primary imports, except scrap, which remains exempt. This exception lets recyclers outbid global peers.

-

China’s Import Quotas: Tight restrictions since 2023 have cut primary aluminum flows, boosting scrap demand.

-

India’s Anti-dumping Duties: 10% levied on certain ingots—pushing buyers toward domestic scrap.

In short, policy tweaks often drive short-term price spikes; but long-term fundamentals prevail.

6. Case Study: “GreenTurn Recycling Ltd.”

GreenTurn Recycling, a mid-size U.S. scrap yard, faced a 25% hike in incoming tonnage during Q1 2025. Here’s what I learned on the ground:

-

Negotiated Volume Discounts with local aluminum fabricators, securing stable feedstock at $0.80/lb.

-

Invested in Eddy-current Separation to boost UBC recovery from 85% to 94%.

-

Leveraged Futures Contracts to hedge price swings—locking in $1,950/t for Q3 2025.

Result? They improved gross margins by 12% compared to the prior year quarter. That’s value‐added strategy in action.

7. Future Outlook & Emerging Trends

I see several trends shaping prices:

-

Electrification Push: Auto-industry demand for cast alloys will climb ~ 5% annually.

-

Circular Economy Goals: EU and US targets for 80% recycled content by 2030 will lift scrap demand.

-

Technological Advances: AI sorting and blockchain traceability promise cleaner streams—and higher bid prices.

However, be wary: global economic slowdowns could dampen demand, causing prices to retreat toward energy cost floors.

8. FAQs

-

What is the best way to calculate scrap value?

Calculate net‐back by deducting processing, transport, and handling fees from the local scrap yard bid. -

How often do scrap prices update?

Most indexes update daily; some yard quotes refresh hourly during peak seasons. -

Is it better to bundle scrap shipments or sell in small lots?

Bundling full-truck‐load tons often secures a 5–8% premium versus spot small-lot transactions. -

Can scrap prices be hedged?

Yes. Some metal exchanges offer aluminum futures and options to lock in forward prices. -

Do alloy specifications affect price?

Absolutely. Higher-alloy content (e.g., 6061) can command 10–15% premiums over mixed grades.

Authoritative References

- “Aluminium recycling” — Wikipedia

- “Sustainable Management of Aluminum” — U.S. EPA

- “Indian Aluminum Scrap Standards” — Ministry of Steel, Government of India

- “Chinese National Scrap Recycling Guidelines” — Ministry of Ecology and Environment of China

- “Aluminium Statistical Review” — International Aluminium Institute