We find that color coated steel coil for household appliances in 2025 remains an economically essential, technically mature product: it combines corrosion protection, consistent decorative finish and formability needed for appliance panels while trading at commodity-like price bands that vary strongly by coating type, substrate and order volume. Below we present a technical, market-aware, and SEO-focused overview written from our experience at luokaiwei, covering materials, specifications, manufacturing, pricing across major markets, selection criteria for appliance manufacturers, test methods, sustainability considerations, and buyer-focused recommendations.

What we mean by “color coated steel coil”

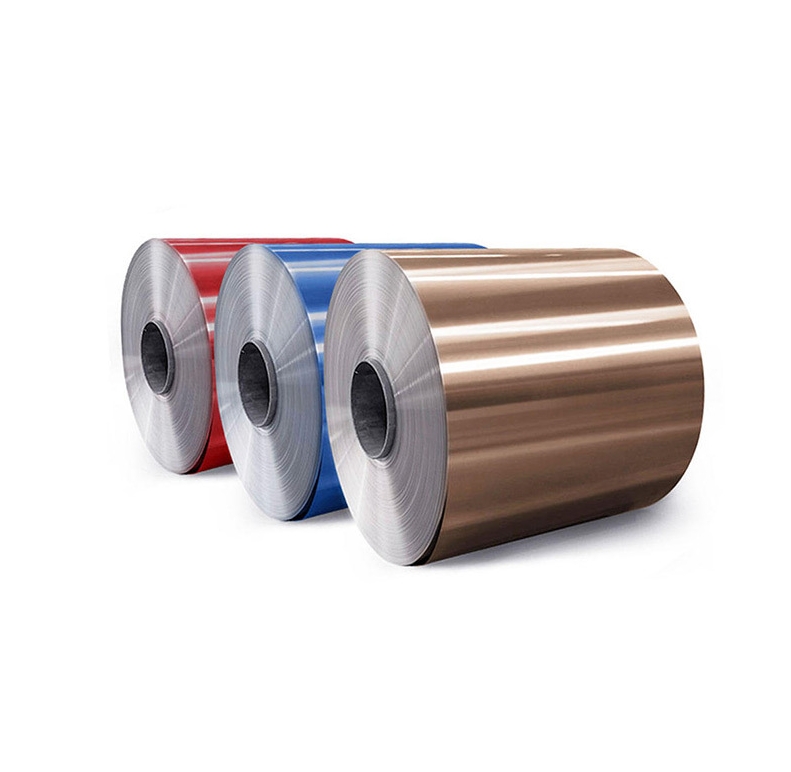

Color coated steel coil—commonly called prepainted steel coil, PPGI (prepainted galvanized iron) or PPGL (prepainted galvalume)—is a continuous steel substrate that has been surface-treated (galvanized or galvalume), coil-coated on both sides with one or more paint/film layers, and wound into coils. For household appliances (refrigerators, washing machines, ovens, range hoods), manufacturers demand surface appearance, formability, corrosion performance and paint adhesion tailored to stamping, bending and final finishing operations.

Base metals and coating chemistries used for appliances

For appliance bodies and visible panels, the most common substrate/coating combinations are:

-

Galvanized steel (GI) with polyester or siliconized polyester (SMP) — popular for white goods where cost and paint flexibility matter.

-

Galvalume (Al–Zn) substrate with high-performance paints (PVDF or high-grade SMP) — used where superior corrosion and weathering resistance is required (or for premium external panels).

-

Stainless-steel coils with thin protective films — for premium finishes and corrosion resistance, though more expensive.

-

Backer coatings and protective PE films are applied to the reverse side to improve forming and to protect the coil during transport and processing.

Coating chemistries in appliance-grade coils typically include polyester (standard and siliconized), plastisol, PVDF for premium resistance, and sometimes PU or epoxy primers in multi-layer stacks.

Typical specifications and standards for appliance-grade coils

Appliance manufacturers rely on consistent dimensional and coating standards. Common tolerances and references include standards for prepainted/coated coil thickness, coating systems and substrate pre-treatment (many mills align with internationally recognized norms such as EN 10169 or ASTM-type references for coil coating quality). Typical thickness and tolerance ranges for appliance coil production are 0.2–0.7 mm strip thickness, with tolerance on thickness often ±0.02 mm for tighter production lots.

Surface, mechanical and functional properties that matter

When we evaluate color coated coil for appliances, we focus on a tight set of properties:

-

Coating adhesion and flexibility — panels will be formed and deep-drawn; coatings must pass T-bend and cupping tests without cracking.

-

Scratch and abrasion resistance — specified by pencil hardness and other abrasion tests. Appliance panels get daily handling and installation wear.

-

Paint film thickness & uniformity — topcoat typically ranges from 15–25 µm per side for standard polyester systems; higher for premium systems.

-

Color consistency — ΔE color difference tolerances ±0.5 or tighter for visible appliance surfaces.

-

Corrosion resistance (salt spray, humidity) — appliance components often require protection during transport and in-home use; back-coating and edge protection are considered.

-

Formability (E-cupping, elongation) — appliance stamping requires coils that will not flake or peel under local plastic strain. We test using E-cupping and impact tests. Typical appliance coil targets include E-cupping performance of several millimeters without delamination. Some suppliers explicitly publish test results such as pencil hardness ≥ H, T-bend ≤ 2T, E-cupping ≥ 6 mm for appliance-grade coils.

Manufacturing and coil-coating process

The coil-coating line is a continuous, highly controlled process:

-

Surface pretreatment — cleaning and chemical conversion coating (zinc passivation / chromate-free alternatives) to ensure adhesion.

-

Primer application — optional primer layer to improve adhesion or corrosion performance.

-

Topcoat application — precise roll-coating of the final paint(s) and infrared/oven curing to form the film.

-

Backer coat — applied to the reverse side to ensure forming and to balance stresses.

-

Winding and inspection — coil is slit/wound and tested for thickness, adhesion, color, and defects before shipment.

Control of oven temperature, line speed, paint viscosity and pretreatment chemistry governs final film properties and consistency.

Typical dimensions, packaging and lead-time considerations

-

Coil width: commonly up to 1,250–1,600 mm (appliance sheet widths are determined by end-part nesting).

-

Coil inner diameter: 405 mm or 508–610 mm depending on mill standards.

-

Coil weight: commonly 3–8 tons per coil for export-sized coils; domestic supply coils may be smaller.

-

Protective films: PE protective film is common for finished coils and slit sheets destined for visible appliance panels.

-

Lead times: vary by supplier and order size; big OEM contracts often secure multi-month scheduling on high-demand paint colors.

Global pricing in 2025 — how to read price ranges

Price for color coated coil in 2025 depends on multiple variables: substrate (GI vs GL vs stainless), coating type (standard polyester vs PVDF), coil width/thickness, color complexity (special effects, metallics), surface finish, order volume, and logistics. Publicly observable price listings and trading pages in 2025 show wide ranges depending on MOQ and buyer-supplier relationship. Market listings from major supplier portals and trading platforms show examples where wholesale PPGI/PPGL coil prices are commonly quoted in the rough band of US$450–1,200 per metric ton depending on specification and volume. Smaller MOQs or printed/embossed coils commonly sit at the higher end of the range.

Global price comparison table — indicative 2025 retail/wholesale ranges (per metric ton)

Note: figures below are compiled from public B2B listings and represent indicative ranges for typical appliance-grade color coated coil (0.35–0.5 mm thickness, standard polyester or SMP topcoat). Specific quotes will vary by supplier, color, and commercial terms.

| Region / Source | Typical Price Range (USD / ton) | Typical substrate & coating | MOQ notes |

|---|---|---|---|

| China — wholesale listings (Made-in-China examples) | $454 – $1,200 | GI / GL, polyester, SMP; PE protective film common. | MOQ 1–20 tons; lower per-ton at larger lots. |

| China — trading platform quotations (Alibaba samples) | $500 – $750 | PPGI with decorative prints or plain colors; 0.14–0.5 mm. | Typical MOQ 20 tons on some offers. |

| OEM contract (regional premium suppliers — Europe / N. America) | Higher than China spot, often premium for PVDF or custom colors | Galvalume + PVDF or SMP with certified performance | Long-term contracts; price depends on currency and logistics. |

| Specialty stainless / embossed finishes | Substantially higher (stainless raw material + finishing) | Stainless with protective film | Small-order premiums. |

(The table compiles public supplier list prices and market reports; buyers should request formal quotations with full spec sheets and incoterms for binding pricing.)

Typical tests and quality control for appliance-grade coils

Appliance manufacturers expect documented quality control including:

-

Pencil hardness — to show topcoat scratch resistance (e.g., ≥ H).

-

T-bend / mandrel bend — adhesion and flexibility under sharp bends (e.g., ≤ 2T for many appliance finishes).

-

E-cupping — to measure formability and resistance to cracking under cup deformation (values of 4–8 mm commonly reported for appliance-grade coils).

-

MEK double rubs — solvent resistance (e.g., >100 double rubs).

-

Salt spray / humidity tests — for corrosion resistance when required by application.

-

Colorimetry — ΔE measured across production lots to ensure uniform look. Suppliers often publish such test results as part of their product sheets.

How we select coil for household-appliance production

When specifying coil we recommend this sequence:

-

Define end-use: exterior visible door? internal cabinet? structural back panel? Each has different performance needs.

-

Choose substrate: GI for cost balance; GL (galvalume) for improved corrosion protection; stainless where aesthetics or hygiene needed.

-

Pick coating system: standard polyester or siliconized polyester for economy; PVDF for premium UV/weather stability.

-

Request full data: film thickness, adhesion, cupping, salt spray, pencil hardness, color tolerance.

-

Ask for manufacturer test certificates and independent lab test reports for critical properties.

-

Run a stamped-part trial using the supplier’s coil to verify real forming behavior.

-

Check packaging and protective films appropriate for your stamping and painting line to avoid scratch during logistics.

-

Negotiate supply terms (lead time, roll weights, slitting tolerances, warranty terms).

We treat sample stamping trials and short pre-production runs as mandatory—lab numbers do not always predict real-press performance.

Market trends in 2025 impacting price and supply

Several market forces are shaping coil availability and pricing in 2025:

-

Raw steel and zinc/aluminum feedstock costs — upstream steel market volatility directly moves coil pricing.

-

Demand from construction and roofing — coil-coating capacity is shared across roofing/cladding and appliance segments; shifts in construction demand can tighten coil supply. Market forecasts and industry reports show healthy global coil-coating market growth projections and differing market-size estimates from research houses, reflecting segmentation and methodology differences. Some sources estimate coil-coating market valuations in the low billions for 2025; others project higher global pre-painted steel market totals depending on inclusion of specialty coatings and laminated products.

-

Color and decoration trends — specialty prints and textured finishes command premiums and longer lead times.

-

Environmental and regulatory shifts — movement to VOC-lower coatings and chromate-free pretreatments increases process costs for suppliers who comply early.

-

Localized sourcing strategies — OEMs increasingly balance China spot sourcing with nearby supplier contracts to reduce logistics risk.

Because multiple market-research providers use different definitions (coil-coating vs pre-painted steel industry vs PET film-coated subsegments), reported market values for 2025 vary across reputable reports; buyers should compare methodologies when using those figures for planning.

Sustainability, recyclability and regulatory perspective

-

Recyclability: Steel with paint/film coatings is recyclable through standard ferrous scrap streams—coated steel remains one of the more circular building materials if collected properly.

-

Coating chemistry trends: Movement away from heavy chromates toward trivalent passivation and chrome-free chemistries is a priority for many mills selling to appliance OEMs with global compliance needs.

-

End-of-life considerations: Appliances are often recycled in regulated streams; knowing the paint system helps recyclers manage emissions during remelting.

-

Supplier compliance: We recommend asking suppliers for RoHS, REACH (as applicable), and mill environmental certifications.

Purchasing tips and negotiation points

-

Locking a multi-month or annual supply agreement usually results in better unit pricing and secured capacity for popular colors.

-

Request full technical data sheets (TDS) and material test reports (MTR) matching your lot acceptance criteria.

-

When buying at spot rates from trade platforms, always verify coil origin, coating brand (e.g., internationally known paint houses), and confirm protective-film application to protect visible surfaces.

-

For visible door panels ask for color and gloss samples and insist on ΔE measurements between lots to ensure visual consistency.

Frequently Asked Questions

Q1: What is a reasonable price range for appliance-grade color coated coil in 2025?

A: Public wholesale listings and supplier platforms in 2025 commonly show rough ranges between about US$450 and US$1,200 per metric ton, depending on thickness, coating system and volume. Exact quotes require a full specification and incoterms.

Q2: Which coating is most cost-effective for refrigerator outer doors?

A: Siliconized polyester (SMP) is frequently selected for a balance of cost and performance for indoor appliance doors; PVDF is chosen for premium durability and colorfastness where budget permits.

Q3: How do I check whether a coil will survive heavy forming without cracking?

A: Require E-cupping and T-bend test results from the supplier and run a tool trial with stamped prototype parts. Published supplier performance data for appliance coils typically includes E-cupping and pencil hardness numbers.

Q4: Are printed or embossed coils more expensive?

A: Yes—printed, embossed or metallic-effect coils typically carry a premium because of extra process steps (printing/embossing dies) and higher scrap risk; MOQ and lead time impacts also raise effective per-ton costs.

Q5: How do global market reports compare for coil-coating market size?

A: Different market-research providers use varying definitions—some report coil-coating submarkets in the low single-digit billions for 2025, while others that include broader pre-painted steel segments show higher valuations. This explains why reputable reports sometimes show different 2025 totals; consult methodology when comparing studies.