We estimate the global market price for 1100 aluminum plate in 2025 generally ranges from about US$1,700–4,500 per metric ton, with retail-cut sheet prices in retail/DIY channels varying from ~US$15–$200+ per small cut depending on size and thickness; these figures depend strongly on order quantity, temper, finish and delivery location.

What is 1100 aluminum plate

We treat 1100 as the commercially pure aluminum (Al 99.0% min) used where excellent formability, corrosion resistance and thermal/electrical conductivity matter more than strength. It is an annealed, non-heat-treatable grade with excellent ductility and high electrical/thermal conductivity but relatively low tensile strength compared with aluminum alloys in the 2xxx–7xxx series. This combination makes it ideal for forming, deep drawing and applications where corrosion resistance and workability are priorities rather than structural loading.

Market snapshot and price signals for 2025

In 2025 the market shows wide dispersion in prices because of differing sales channels (B2B tonnage vs B2C cut-sheets), regional cost structures, and material processing (hot-rolled versus cold-rolled, H14 vs O temper). For example, retail cut prices in North American online suppliers typically list small cut sheets in the range of US$15–$200+ depending on size and thickness, while bulk tonnage offers from manufacturers and trading platforms quote roughly US$1,700–4,500 per metric ton in typical public listings and supplier catalogs. These values shift with local scrap/ingot markets and freight.

Why price varies

We break price drivers into five pragmatic categories:

-

Primary aluminum feedstock and scrap: The cost of primary aluminum (ingot, billet) and regional scrap markets is the single largest driver for plate price. Smelter availability, energy costs and tariffs flow quickly into domestic plate prices.

-

Order scale and product form: Coil/plate sold by the ton is much cheaper per kg than pre-cut, small-quantity sheets. Custom cutting and packaging drive per-piece retail prices upward.

-

Temper and finishing: O (annealed), H14 (work-hardened) or special surface treatments (clean, mirror, painted) add processing steps and cost.

-

Thickness and width: Heavier gauge plates require more raw metal and rolling; tight thickness tolerances or narrow specialty sizes may cost more.

-

Logistics and lead time: Freight, duties, minimum order quantities and inland transport (especially for oversize plates) add materially to landed cost.

Together these variables explain why a 1 ft² 0.04″ sheet may cost a few tens of dollars at a retail site while a metric ton sold from a trading company appears as low as mid-thousands USD per ton.

Regional pricing patterns and buyer examples

We summarize observed public pricing to give a realistic picture for different buyer types.

-

North America — retail and small-batch: Online metals and supply houses show small cut sheets and plates at retail prices (examples: 12"×12" cut sheets ranging around US$15–US$33 depending on thickness and cutting). These listings are useful for prototyping and small projects.

-

India — domestic and export quotes: Vendor catalogs and B2B price lists show a broad band — some sellers list 1100 plate prices from roughly US$1,800 to US$4,500 per metric ton depending on hot-rolled/cold-rolled and MOQ. Indian supplier price pages show overlapping ranges reflecting varied grades, supply constraints and shipment terms.

-

China & global trading platforms: Marketplaces and factories often list OEM/wholesale prices in ranges that depend on MOQ; prices on platforms can appear competitive for large orders but require verification of temper, thickness and finish. Alibaba and made-in-China listings present per-ton price bands and per-kg ranges depending on order size and product spec.

-

Retail distributors and specialist suppliers: Industrial distributors and specialty shops show per-unit examples (e.g., thin shim stock or H14 sheets with per-piece pricing). These are accurate indicators for small-volume buyers but not representative of bulk quotes.

Typical specifications, tempers and dimensional availability

We keep this concise but practical for procurement teams:

-

Chemical standard: Commercially pure aluminum (~99.0% minimum Al).

-

Common tempers: O (annealed), H14 (strain-hardened), H18 (harder) — temper affects formability and strength.

-

Thickness range: From thin shim stock (fractions of a millimeter) to plate thicknesses of several millimeters and beyond; common sheet/plate stock is stocked in standard full-size sheets (e.g., 4×8 ft or metric equivalents) and custom cuts are available.

-

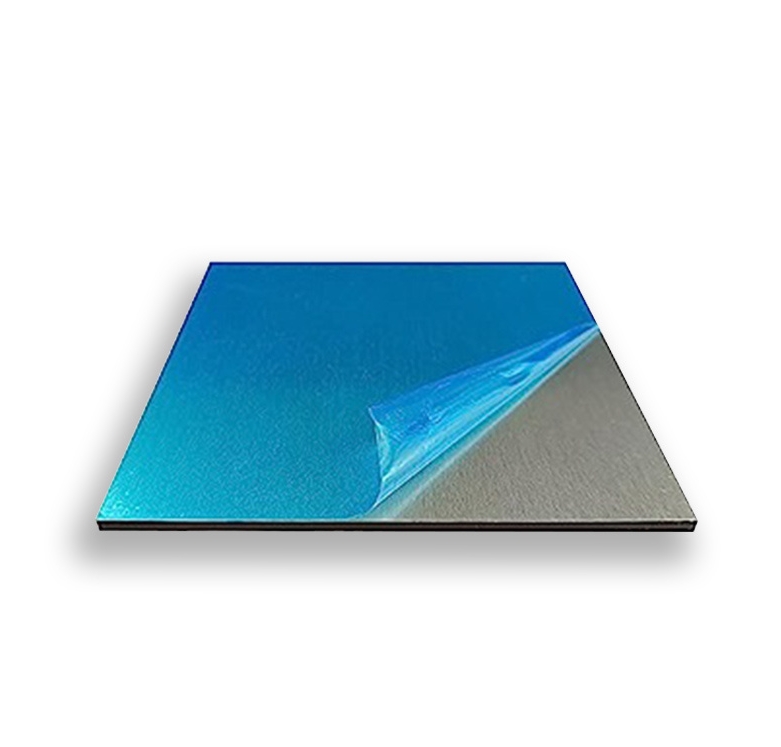

Surface finishes: Mill finish, polished, coated (paints, PVDF), anodized (less common for 1100 than for 5xxx/6xxx series). Surface treatment increases price.

-

Tolerance & flatness: Tight tolerances or specialty flatness specs add cost because of extra processing and inspection.

Common applications and why 1100 is chosen

When we advise customers, 1100 is recommended where workability and corrosion resistance matter more than structural strength:

-

Food-handling equipment and containers (good corrosion resistance and weldability).

-

Decorative trim and signage (forms easily, accepts simple surface treatment).

-

Heat exchangers and reflectors where thermal conductivity is beneficial.

-

Chemical processing internal parts that do not carry heavy loads.

-

Prototype sheet metal parts because of its forgiving forming behavior.

These use-cases mean some buyers will willingly pay slightly more for easier forming and reduced scrap during stamping or deep-drawing operations.

Purchasing guidance — how we recommend buying to get the best total cost

We outline a practical procurement checklist for buyers to reduce unit cost and risk:

-

Buy to application, not to the grade name only: Confirm temper and physical properties required. Avoid over-specifying strength when formability is the priority; that reduces cost.

-

Compare like-for-like quotes: Ensure thickness, temper, finish, and included services (cutting, deburring, packaging) match across quotes.

-

Use bulk orders for large programs: Per-ton pricing becomes attractive onceMOQ thresholds are met. Trading catalogs show big swings between per-piece retail and per-ton wholesale pricing.

-

Factor landed cost: For international purchases include freight, import duty, insurance, inland delivery and inspection costs into unit economics.

-

Ask for certificates: Request mill test reports (MTRs) and temper certification; quality variations can create callbacks that are more expensive than small premium paid up-front.

Fabrication, forming, welding and finishing notes that affect price/performance

We advise fabricators about hidden costs:

-

Forming/springback: 1100 is forgiving, but certain tempers (O vs H14) will behave differently — check prototypes.

-

Welding and joining: Excellent weldability reduces the need for welding prep; fewer rejects lower total project cost.

-

Surface finish and post-processing: Deburring, polishing and coating are often charged separately; plan them into RFQs.

-

Scrap & yield: Optimizing nesting and cut patterns can dramatically lower effective price per usable kg for small orders; speak with your cutter or supplier to minimize offcuts.

Better process planning frequently reduces effective cost more than negotiating raw metal price.

Sustainability, recycling and lifecycle cost impact on price

We note two practical sustainability points:

-

High recyclability reduces long-term cost volatility: Aluminum’s high scrap value keeps a price floor; local scrap markets therefore influence mill and distributor pricing.

-

Lifecycle view: For applications with long service life and low maintenance, selecting a slightly higher-quality surface finish or tighter tolerance can lower life-cycle costs even if upfront price is higher.

In procurement we recommend lifecycle total cost assessments rather than simple unit price comparison.

Competitive alternatives and when to choose them

We provide decision criteria comparing 1100 with other commonly considered alloys:

-

1050 / 1060: Very similar properties; choose by supplier availability and pricing.

-

3003: If you need modestly higher strength with still good formability and corrosion resistance, 3003 is a close step up.

-

5xxx (e.g., 5052): If structural loading or better corrosion resistance in marine environments is required, 5xxx alloys may be more cost-effective despite a higher raw price because fewer parts or reinforcements are needed.

-

6xxx (e.g., 6061): For structural or machinable parts that need higher strength, 6061 is preferred — but it has different forming behavior and is heat-treatable.

Choose based on mechanical requirements, forming method, and environmental exposure — not just raw per-ton price.

Global price comparison table

Below is a compact table summarizing observed public price indicators (representative public listings and supplier pages in 2025). These are illustrative and should be validated with current supplier quotes for procurement decisions.

| Region / Channel | Typical public price indicator (2025) | Notes / example sources |

|---|---|---|

| North American retail (small cut sheets) | US$15–US$200+ per small cut (varies by size & thickness) | Online retail/industrial sellers list 12×12 to larger cut sheets in this band. |

| India (B2B trading lists) | US$1,800–US$4,500 per metric ton | Public price lists and supplier pages show wide ranges reflecting grade, roll vs plate, and MOQ. |

| China / Export platforms | Varies; broadly competitive for large MOQ; per-ton quotes on marketplaces | Marketplace listings (manufacturers & trading companies) show per-ton bands; verify spec and incoterms. |

| Specialist shim/annealed stock | Per-piece pricing (higher per-kg) | Specialty shim stock and tight-tolerance sheets show higher per-kg retail prices. |

| Example small retail item | ~US$27 per 12×24 thin H14 sheet | Example retail SKU listing for 1100-H14 shows specific per-piece pricing. |

Interpretation: bulk buyers should expect per-ton negotiations near the lower end of the regional wholesale bands. Small buyers purchasing cut parts will see substantially higher per-kg costs due to processing, packaging and retail overhead.

FAQs

Q1 — What is the best way to buy 1100 plate if I need large volumes?

A1 — We recommend negotiating with mills or authorized distributors on a per-ton basis, specify temper and finish exactly, include a clear incoterm and ask for mill test certificates. For repeated programs, contract pricing and scheduled deliveries often reduce unit cost.

Q2 — How can I compare quotes fairly between suppliers?

A2 — Normalize quotes to delivered, finished, and inspected conditions (include cutting, protective film, packaging, freight, and duties). Confirm thickness, temper, full chemical spec and MTR availability so apples-to-apples comparison is possible.

Q3 — Will temper (O vs H14) change the price significantly?

A3 — Temper itself is a modest price factor; the bigger cost impacts come from additional processing (work-hardening passes, annealing cycles, special finishes). Tell suppliers your forming method to let them propose the optimal temper and lowest total cost.

Q4 — Is it cheaper to import 1100 plate or buy locally?

A4 — It depends. Large tonnage orders can be cheaper out of major production regions once freight and duties are included, but sample, lead-time and quality control costs can offset savings. Always calculate landed cost and lead-time risk.

Q5 — How stable are 1100 aluminum prices and what should I watch?

A5 — Prices follow primary aluminum and scrap markets, energy costs at smelters, and geopolitical trade conditions. Monitor local scrap price and major exchange trends, and build flexible sourcing (dual suppliers) to mitigate spikes.