For 2025 the typical market asking price for 5A05 aluminum plate sourced from China sits roughly in the USD 2,000–3,000 per metric ton band for bulk FOB/container shipments; European and North American delivered prices are usually higher because of premiums, logistics and local demand, often placing plate-grade premiums in the USD 3,000–4,800 / MT window depending on grade and temper. The 5A05 alloy is an Al–Mg family sheet/plate with relatively high magnesium (≈4.8–5.5%), good corrosion resistance and moderate strength; it is widely used for medium-load structural components such as tanks, piping, and automotive/non-structural panels.

Alloy identity and equivalence

5A05 is a magnesium-bearing aluminum alloy from the Al–Mg series. In Chinese domestic designation systems it is usually shown as 5A05, and its chemistry and behavior align with other Al–Mg alloys used globally for corrosion-resistant sheet/plate. Typical analysis places magnesium in the ~4.8–5.5% range plus small amounts of manganese and trace elements; silicon and iron are low. Because of that magnesium level, 5A05 behaves like a medium-strength, non-heat-treatable Al–Mg product (cold work can raise strength). Industry sources list its composition and properties consistently with this classification.

Chemical composition

A representative specification for 5A05 plate contains the following approximate elemental ranges (percent by weight):

-

Mg: 4.8 – 5.5

-

Mn: ~0.30 – 0.60

-

Si: ≤ 0.50

-

Fe: ≤ 0.50

-

Cu: ≤ 0.10

-

Zn: ~0.20 (trace)

-

Balance: Al (aluminum)

Those numbers are typical for Al–Mg alloys used in sheet/plate; different mills and countries may publish slightly different limits and tolerances. When exact composition matters for design or certification, always ask for the mill test certificate (MTC).

Mechanical and physical properties

In practice the mechanical performance depends heavily on temper (O, H1x, H2x, etc.) and final thickness. Typical values for good-quality commercial 5A05 plate (representative ranges) are:

-

Ultimate tensile strength: ≥ 200–250 MPa (often ≥225 MPa in common datasheets).

-

Yield strength (0.2% proof): around ≥ 100–140 MPa depending on temper.

-

Elongation (A%): typically ≥ 12–18% in the annealed condition.

-

Density: about 2.7 g/cm³ (standard Al).

-

Thermal & electrical: values follow generic Al–Mg patterns (lower conductivity than pure aluminum).

Because 5A05 is not strengthened by heat treatment, cold work is the usual way to increase strength. Typical product literature lists these strengths and elongations for the common tempers offered by plate mills.

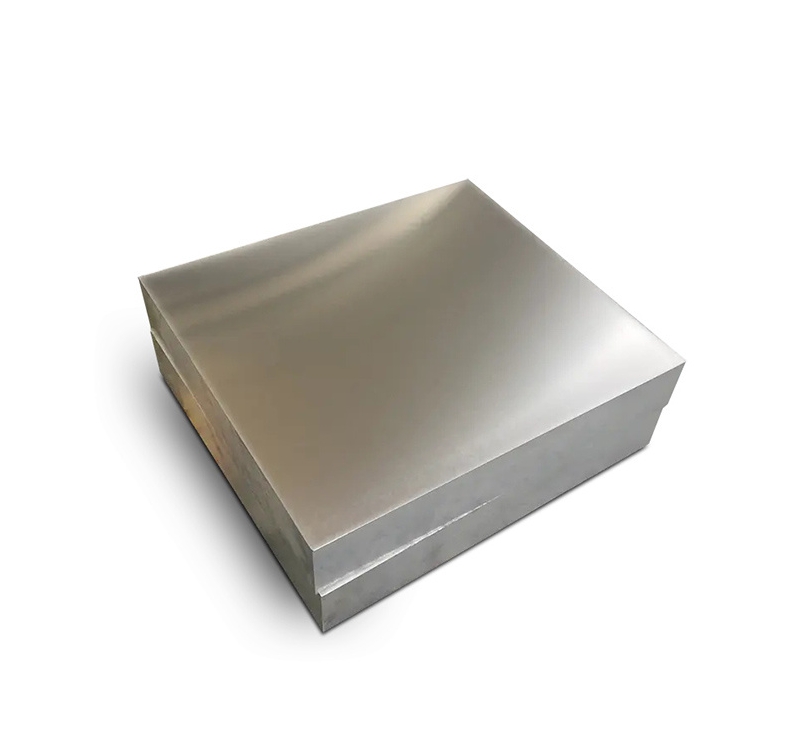

Product forms, tempers and typical dimensions

We supply 5A05 in plate and sheet forms, commonly in thicknesses from 1.0 mm to 200+ mm, though most commercial plate business concentrates on the 1.5–50 mm range. Common tempers include:

-

O (annealed): maximum ductility, easier forming.

-

H1x/H2x family (strain hardened / partially annealed): increased strength by cold work.

-

F (as fabricated): custom condition for specific processing.

Widths and lengths follow mill rolling capabilities (typically up to 2,500 mm width or larger in some mills). Surface finishes offered include mill finish, peeled, bright, and optionally coated (anodized or painted as extra processing). Mills can supply cut-to-size blanks, slitting, CNC blanks, and pre-drilled or machined plates for repeat orders.

Corrosion resistance, painting and welding

5A05 provides excellent resistance to general and marine corrosion thanks to the relatively high magnesium content. That makes it suitable where a combination of strength and corrosion resistance is needed without the cost of high-end alloys.

Weldability: 5A05 is generally weldable by standard methods (TIG, MIG, spot welding) with good performance; weld filler selection and post-weld treatments depend on joint design and service environment. In many cases the weld area will be slightly less corrosion-resistant than the parent metal, so design for drainage, use of compatible filler metal and surface finishing are common practice.

Common applications and market drivers

Because of its profile, 5A05 is commonly used for:

-

Fuel and storage tanks, oil and lubricating oil containers.

-

Hydraulic piping and low- to medium-load structural panels.

-

Marine and coastal components where salt spray resistance is demanded.

-

Automotive non-structural panels and components where corrosion resistance is prioritized.

-

Pressure vessels and liquid containers for chemicals compatible with Al–Mg alloys.

Market demand for 5A05 follows sectors such as automotive production, shipbuilding, container manufacturing and industrial equipment. When automotive or marine demand expands, plate volumes and premiums can rise quickly. Conversely, if primary aluminum and scrap prices climb, finished plate prices follow.

Global price comparison (2025 market picture)

Price for plate-grade aluminum combines the base aluminum commodity price (LME or regional benchmark) plus alloy premium, processing, and logistics. For 5A05 plate in 2025 we see the following typical bulk price bands (market averages and FOB/EXW indicators):

| Region / Incoterm | Typical 2025 price band (USD / metric ton) | Notes |

|---|---|---|

| China — FOB (bulk container) | 2,000 – 3,000 / MT. | Many Chinese suppliers list 5A05 within this range for standard thicknesses and MOQ (ton-scale). |

| North America — Delivered (import/stock) | 2,800 – 4,200 / MT. | Import averages for sheet/plate can be higher due to logistics, tariffs and local premiums. |

| Europe — EXW / Delivered | 3,200 – 4,800 / MT. | European plate prices vary by alloy; plate-grade premiums are material and temper dependent. |

| India / South Asia — CIF / Delivered | 2,200 – 3,500 / MT. | Import reliance and local demand drive premiums; domestic supply affects final numbers. |

| Middle East / GCC — CIF | 2,400 – 3,600 / MT. | Regional procurement and downstream demand matter; port charges and trucking add cost. |

How to interpret the table: these are market ranges, not guaranteed offers. Specific quotes depend on order size, thickness, temper, surface treatment, payment terms, and shipping terms (FOB, CIF, DDU). We note Chinese mill FOB prices are commonly listed in supplier catalogs and B2B platforms in the USD 2k–3k/MT band for 5A05, while European/US delivered plate prices include higher manufacturing and logistics costs.

Why prices vary

When we price 5A05 plate we break it into components:

-

Base aluminum raw material (ingot/billet) price: tracked on LME and regional assessments; this is the largest single driver. Market benchmarks for primary aluminum averaged roughly USD 2,300–2,700/MT in much of 2024–2025, with volatility.

-

Alloy premium: magnesium-heavy alloys carry a premium over primary ingot pricing because of alloying and processing complexity.

-

Processing & tempering costs: heavy rolling, cold reduction, leveling, and surface finishing raise price per tonne.

-

Quality control, testing and certification: MTCs, PMI, and traceability documentation add cost—especially for orders intended for regulated industries.

-

Logistics and duties: ocean freight, inland transport, insurance and any tariffs. Recent trade policy changes can add material cost.

-

Order size & lead time: smaller orders and fast lead times increase per-ton prices; long-term contracts reduce them.

Understanding these components helps buyers decide whether to prioritize lower unit-price FOB offers or to accept higher delivered prices for reduced lead time and lower supply-chain risk.

Practical buying advice

-

Specify temper and thickness precisely. Price changes significantly between thin coil/sheet and heavy plate; tempers determine mechanical values.

-

Ask for an MTC (mill test certificate) and chemical analysis. Request both a full spectrometric report and mechanical test report.

-

Compare total landed cost. A low FOB rate from a distant mill can become more expensive after shipping, duties, and inspection.

-

Check lead times and availability. Plate production slots and rolling mill capacity drive delivery schedule—and sometimes price.

-

Negotiate MOQ and payment. Bulk buys and repeat orders secure better pricing and priority slots.

-

Consider local inventory partners. Sometimes an authorized distributor will reduce administrative overhead and accept smaller lots at modestly higher unit cost.

We recommend pre-agreement on inspection methods (visual, dimensional checks, ultrasonic testing as needed) and acceptance criteria before production begins.

Quality checks and inspection checklist

Before accepting 5A05 plate, perform or require the following:

-

MTC verification: alloy analysis, mechanical tests, heat number traceability.

-

Dimensional check: thickness tolerance, flatness, width and length.

-

Visual surface inspection: for pitting, scaling, rolling defects.

-

Ultrasonic or eddy-current testing for critical plates if internal defects are a concern.

-

Hardness & microstructure checks when application requires specific toughness or forming behavior.

-

Weld test coupons for qualified weld procedures where welding is required.

Our factory practice is to attach an MTC (EN 10204/3.1 or equivalent) to each batch and offer third-party inspection on request for high-value deliveries.

Certifications, standards and traceability

Typical standards and documentation buyers request for 5A05 plate include:

-

Mill Test Certificate (MTC) EN 10204 / 3.1 (or equivalent).

-

Chemical and mechanical test reports with heat/batch numbers.

-

RoHS/REACH declarations if plating/painted surfaces are used for regulated markets.

-

Customer-specific certifications (ISO 9001, and sometimes ISO 45001 or industry-specific quality schemes).

-

Traceability chain back to primary ingot and heat number.

Always confirm which standard your customer or project requires and make it a contractual item.

Handling, storage and recycling

-

Storage: store plates flat on dry supports, separated by timber dunnage or protective layer to avoid surface damage and corrosion. Keep humidity and salt exposure low during storage.

-

Handling: use soft slings, spreader bars or lifting lugs to avoid denting or bending. Avoid dragging across dirt or abrasive surfaces.

-

Recycling: 5A05 is fully recyclable; reclaimed 5xxx-series scrap is valuable to secondary smelters. Recycling reduces life-cycle cost and environmental footprint and is well supported in global aluminum supply chains.

Sustainability and lifecycle considerations

Aluminum’s overall environmental performance depends on primary versus recycled content and the energy mix used in smelting. When possible, buy material with verified recycled content or low-carbon aluminum to reduce embedded emissions. For regulatory or corporate sustainability reporting, ask suppliers for recycled-content certificates and cradle-to-gate CO₂/energy data.

Market signals buyers should watch

We recommend tracking these indicators before negotiating large purchases:

-

LME or regional primary aluminum benchmarks (these set the base).

-

Magnesium metal price (affects Al–Mg alloy premium).

-

Freight rates and port congestion (impacts delivered CIF price).

-

Regional demand drivers: automotive output, shipbuilding orders, infrastructure projects.

-

Trade policy changes (tariffs and quotas can materially change landed cost).

Example of a sourcing scenario

Suppose a buyer needs 50 MT of 5A05, 3 mm thickness, H14 temper, FOB Shanghai. We would:

-

Confirm required tolerances, finish and test certificates.

-

Check mill stock and rolling schedule—if inventory is available, lead time shortens and price leans to the low end of the band.

-

Offer FOB quote that includes MTC and packing, with option for third-party pre-shipment inspection.

-

Advise on shipping: consolidation vs direct container, insurance and typical transit times.

Small orders (under 5–10 MT) face higher per-ton costs because of cutting, handling and non-bulk freight.

How we differentiate product & service (what to request from a vendor)

When you evaluate offers, prefer vendors who can provide:

-

Full MTC traceability and heat numbers.

-

Photos of actual plate stock, not just catalog pictures.

-

Warranted dimensional and surface specs.

-

Packing that protects against moisture and salt during ocean transit.

-

Clear lead-time commitment and penalty clauses (if critical).

We include these items in our standard commercial offers because they reduce downstream risk for fabricators.

Global price table

(Repeat of earlier priced summary in compact form)

| Market region | Typical 2025 band (USD/MT) | Source indicators |

|---|---|---|

| China FOB | 2,000 – 3,000 | B2B supplier listings and trade offers. |

| North America (delivered) | 2,800 – 4,200 | Import/market reports and plate price assessments. |

| Europe (delivered) | 3,200 – 4,800 | European plate premiums and spot assessments. |

| India / South Asia | 2,200 – 3,500 | Regional import offers and domestic listings. |

| Middle East / GCC | 2,400 – 3,600 | CIF offers & regional demand indications. |

FAQs

Q1: Is 5A05 the same as 5050/5052/5083?

A1: Not exactly. 5A05 is an Al–Mg alloy similar in family to 5052/5083 but it has its own specified Mg% and mechanical profile. Conversion charts often show approximate equivalence to international grades, but always compare exact composition and properties rather than relying solely on names.

Q2: Can 5A05 be heat-treated to raise strength?

A2: No. 5A05 is not heat-treatable for strength gains; mechanical strength increases come from cold working (strain hardening) and temper selection.

Q3: How much thicker is plate priced relative to sheet?

A3: Plate (heavier gauge) usually carries a processing premium compared with thin sheet because of heavier rolling, greater energy and different annealing/flatness processes. In many markets the per-ton price difference depends on thickness bands and production runs; ask suppliers for specific thickness-dependent pricing.

Q4: What packaging/packing is recommended for ocean shipment?

A4: Pack in sealed, waterproof crates or bundles with VCI (volatile corrosion inhibitor) paper and moisture-resistant film. Use timber dunnage to prevent deformation. For long sea voyages choose corrosion-inhibiting packaging and desiccants as necessary.

Q5: How to check authenticity and avoid counterfeit material?

A5: Require the mill’s MTC (EN 10204), confirm heat numbers, request independent third-party inspection for large orders and, where critical, perform laboratory chemical verification or spectrometric testing on samples before full acceptance.