We find that 6063 aluminum — prized for its excellent surface finish, anodizing friendliness, and good formability — is actively used in thin-gauge foil and specialty foil applications; in 2025, aluminum-foil market dynamics (energy, LME/primary aluminum movements, and regional tariffs) have pushed foil prices into a range roughly between USD 3,600–5,200 per metric ton for general packaging foil grades, while specialized battery/industrial foils command higher processing premiums. For buyers seeking factory-direct supply, we at Luokaiwei offer competitive, factory-price advantage (100% factory pricing), customization, and fast delivery from China — positioning us as a pragmatic partner when price volatility and lead-time matter.

What is 6063 aluminium and why it matters for foil

6063 is an aluminium–magnesium–silicon wrought alloy widely used for extrusions because it produces smooth surfaces that anodize beautifully and is easy to form. While 6063 is primarily known as an extrusion alloy, thin-gauge forms (including specialty foil and laminated foil products) are produced or converted from 6000-series parent stock where the alloy chemistry and temper suit the required properties (surface appearance, ductility, and corrosion resistance). The Aluminum Association recognizes 6063 as a commercial alloy family with consistent composition control for Mg and Si.

Key physical & mechanical properties

-

Density: ≈ 2.69 g/cm³.

-

Thermal conductivity: high for aluminium (useful when foil acts as heat spreader).

-

Strength: lower than 6061; good for forming and finishing, not for high-strength structural foil.

-

Surface: smooth, excellent for anodizing and decorative finishes — a key reason architects and converters choose 6063 for visible parts.

Temper conditions and product forms relevant to foil

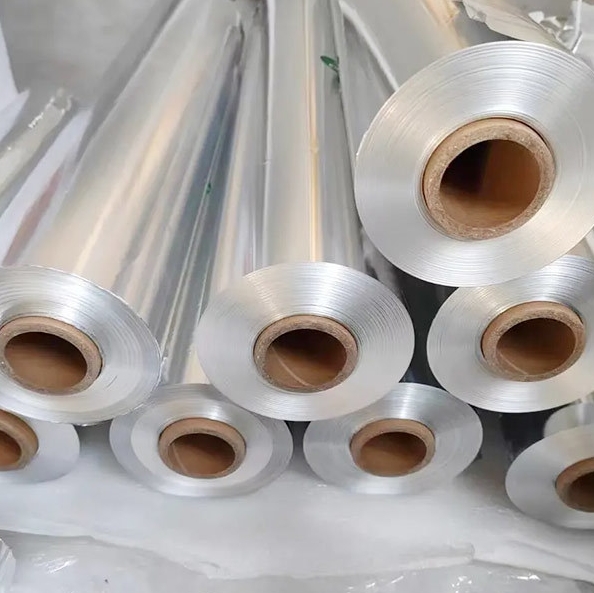

Foil producers select tempering and rolling schedules to balance ductility and tensile strength. Common product forms include: mother coils (wide, thin-gauge), slit coils for converters, and laminated multi-layer foil for packaging or electrical insulation. For specialized battery foils, processing tolerances and surface cleanliness are tighter (and attract higher prices). Technical datasheets from producers (T5/T6 variants where applicable) define the final mechanical results.

How 6063 foil is manufactured and processed

Producing foil typically follows: primary aluminium → hot/cold rolling → intermediate anneals → final rolling to target gauge → slitting/rewinding → finishing (anodizing, embossing, laminating). For 6063, mills may adjust alloy heat treatment to preserve formability and surface condition during heavy cold rolling; converters then slit and treat in controlled atmospheres to limit contamination. Specialized battery foils undergo additional cleaning and coating steps. Processing costs (rolling passes, annealing cycles, slitting precision) add a notable premium above raw aluminium pricing.

Common and specialty applications for 6063 foil

-

Packaging (thin food and pharmaceutical foil): where surface finish and corrosion resistance matter.

-

Architectural laminates and decorative foil: for visible surfaces or membranes.

-

Thermal insulation and heat shielding: in construction or HVAC panels.

-

Electrical/battery industry (specialty foil variants): where controlled alloying and surface cleanliness are required (note: battery-grade foils often use bespoke alloys/processing).

-

Industrial wraps and tapes: where formability and anodizable appearance help. The specific choice of foil alloy depends on the end-use and whether mechanical strength or surface finish is prioritized.

Standards, specs and quality control checkpoints

Buyers should insist on documented compliance with relevant standards and inspections at these stages: chemical composition (AA/Aluminum Association or ASTM equivalents), tensile/elongation tests for specified temper, thickness/tolerance measurements by calibrated micrometers, surface defect inspection (visual + scratch tests), coil flatness and edge quality, and presence/absence of lamination defects for laminated foil. For architectural usage, anodizing qualification and color consistency tests may also be required. Authoritative datasheets (e.g., MatWeb, Hydro, atlas steels) provide typical property values and are useful references.

Market drivers affecting foil prices in 2024–2025

Several factors shaped foil pricing in 2025:

-

Primary aluminium (LME and regional spot) movements: base-material swings are transmitted to foil cost.

-

Energy and processing costs: rolling and cold-processing are energy-intensive; electricity/gas cost changes materially affect mill premiums.

-

Supply-chain tightness for specialty foils: battery/industrial needs, plus export controls or tariffs, can raise premiums.

-

Recycling stream & scrap availability: domestic scrap prices influence converters' feedstock cost.

-

Regional trade policies: duties or quotas (for example on some routes) increase landed cost in importing markets.

Price analysis — raw aluminium vs. rolled/processed foil premiums

Raw aluminium (ingot/billet) prices are the baseline; converting to foil adds mill processing premiums (rolling, annealing, slitting) and sometimes a finishing premium (anodizing, lamination). In 2025 the global averages for general packaging foil (converted product) fall into the mid-thousands USD per metric ton, with battery and precision industrial foils commanding additional processing fees and tighter tolerance surcharges. Regional differences reflect energy, labor, and logistics—China and Southeast Asia often offer lower factory-gate prices; Europe and North America may trade at higher landed costs when tariffs and logistics are included.

Global price comparison table

Notes: figures are market snapshots compiled from public price trackers and market reports for common foil-grade products during 2025. Prices are indicative — exact quotes vary by gauge, temper, coil size, finishing, quantity, and Incoterm. All prices shown are approximate USD per metric ton for converted aluminium foil (packaging/industrial grades) as of mid-2025.

| Region / Market | Indicative price (USD / metric ton) | Source (snapshot) |

|---|---|---|

| United States (converted foil avg.) | ~5,000 – 5,200 | IMARC / Q1–Q2 2025 data. |

| Germany / EU (converted foil) | ~4,600 – 4,900 | IMARC regional figures / European converters. |

| China (factory-gate, converted foil) | ~3,600 – 4,400 | AsianMetal / China spot indices & manufacturer listings. |

| Australia (converted foil) | ~3,600 – 3,900 | IMARC regional snapshot. |

| Turkey (converted foil) | ~4,400 – 4,800 | IMARC / regional price commentary. |

| Argentina (converted foil) | ~4,700 – 5,000 (local currency effects) | IMARC / local FX adjustments. |

| Specialized battery-grade foil (global) | ~7,000 – 14,000+ (depends on thickness, coating) | Metal.com / lithium-battery foil processing premiums. |

Interpretation: China factory gates generally cost less per ton but exporters must add freight, duties, and financing. Battery foils are a separate market tier with distinctly higher processing fees and tighter QC.

Procurement & inspection checklist

When you request quotes and plan procurement, follow this checklist:

-

Technical spec sheet: alloy designation (6063), temper, thickness range, tolerances, coil width, coil weight.

-

Sample request: insist on physical samples for surface, anodize, and mechanical check.

-

Test certificates: chemical composition (spectrometer report), tensile/elongation, and thickness certificates.

-

Factory audit: if order volume is large, arrange an audit or request ISO/QS certificates and mill process flow documentation.

-

Packaging & logistics: anti-corrosion packing, palletization, and container lashing details; determine Incoterm (FOB, CIF, DDP).

-

Payment & lead time: confirm deposit terms, lead time for production vs. stock availability, and penalties for late delivery.

-

After-sales & warranty: acceptance tests and return policy for non-conforming product.

These steps reduce risk and prevent payment for off-spec coils. For rapid procurement, stock items (available in major Chinese hubs) can cut lead times significantly.

Sustainability, scrap & recycling considerations

Recycled aluminium significantly reduces embodied energy; scrap feedstock for 6000-series alloys is widely available and can lower production cost. However, high-reliability foils (battery, pharmaceutical) require controlled scrap streams and certified remelting to avoid tramp elements. Monitoring and documenting recycled content and chain-of-custody will support purchaser sustainability claims. Scrap-price signals also provide early warning of feedstock cost changes.

Why source 6063 foil from Luokaiwei

We are Luokaiwei — a Chinese mill & converter specializing in aluminium products. When you consider supplier selection, here’s why working with us is efficient:

-

Factory-direct pricing (100% factory advantage): we control the mill/conversion stage and can offer highly competitive factory-gate quotes, reducing distributor margins.

-

Customization: we handle custom thickness, slit widths, and finishing (anodize, embossing, lamination).

-

Stock availability: we maintain inventory of common gauges and can ship stock items rapidly (shorter lead times vs. build-to-order).

-

Quality controls: incoming billet inspection, in-process rolling QC, and outgoing test reports are standard.

-

Export experience: we regularly ship worldwide with export packing and documentation (COO, inspection certificates).

If you want a firm quote for 6063 foil, tell us the thickness, temper, coil width, order quantity, and preferred Incoterm — we’ll prepare a cost breakdown that shows mill premium, finishing charges, and shipping. (Note: because foil pricing is sensitive to raw-aluminium swings and energy costs, locking a contract or securing a nearby-stock lot can protect you from sudden spikes.)

FAQs

Q1 — Is 6063 the best alloy for aluminium foil?

A1 — It depends on the application. 6063 is excellent where surface finish and anodizing are priorities; for high-strength or high-conductivity foil applications, other alloys (e.g., 1xxx series for pure aluminium or bespoke 6xxx variants tuned for conductivity) may be preferred. Choose alloy based on mechanical and surface requirements.

Q2 — What drives the biggest price swings for 6063 foil in 2025?

A2 — The biggest drivers are primary aluminium prices (LME/spot movement), regional energy costs for rolling, and demand surges in sectors like packaging and battery manufacturing. Tariffs and logistics constraints can amplify regional differentials.

Q3 — How should I specify tolerances and inspection points in a purchase order?

A3 — Specify chemical limits (per AA/ASTM where relevant), target thickness and allowable ± tolerance (e.g., ±0.005 mm for thin foil), surface acceptance criteria, coil weight, and test certificate requirements. Include acceptance sampling protocol and remedies for out-of-spec deliveries.

Q4 — Can 6063 foil be recycled and still meet quality needs?

A4 — Yes — aluminium is highly recyclable. For critical uses, require certified remelting records and composition checks to ensure recycled content does not introduce impurities. For high-reliability foils, converters often use tight scrap control and segregation.

Q5 — What is a realistic lead time for factory-stock vs. custom 6063 foil orders?

A5 — Stock coils (common gauges) can ship in days to a few weeks depending on port schedules. Custom processed coils (special tempering, anodizing, lamination) typically need several weeks for processing and QC. Always confirm lead times in the contract and ask suppliers about stock locations. Luokaiwei maintains stock for quicker fulfillment.

Practical buying scenario — sample cost breakdown

For a mid-size buyer ordering 10 metric tons of converted 6063 packaging foil (China FOB), an illustrative cost stack might look like:

-

Base aluminium feedstock (ingot/billet) cost — market-driven.

-

Mill processing premium — rolling + annealing + slitting.

-

Finishing premium — anodizing/embossing/lamination (if required).

-

Packaging & handling.

-

Freight & insurance (if CIF/CFR).

-

Customs/duties (if applicable).

Because each component is variable, we recommend requesting itemized quotes showing base metal and processing premiums separately; Luokaiwei will provide such breakdowns so you can compare apples-to-apples between suppliers.