In 2025 the market for coated (prepainted / coil-coated) aluminum coils is driven primarily by LME aluminium fundamentals, regional processing capacities and coating-system costs; as a result, finished coated-coil prices in 2025 typically range from roughly USD 1,000–1,600/ton FOB China, USD 2,200–3,200/ton in India, USD 2,700–3,800/ton for U.S. finished stock, and USD 2,200–3,200/ton ex-works in the EU depending on alloy, film system (polyester vs PVDF), thickness and order size. Buyers who need consistency for architectural PVDF or high-durability systems should budget a premium of several hundred USD/ton above base coil/LME levels.

What is a coated (prepainted) aluminium coil?

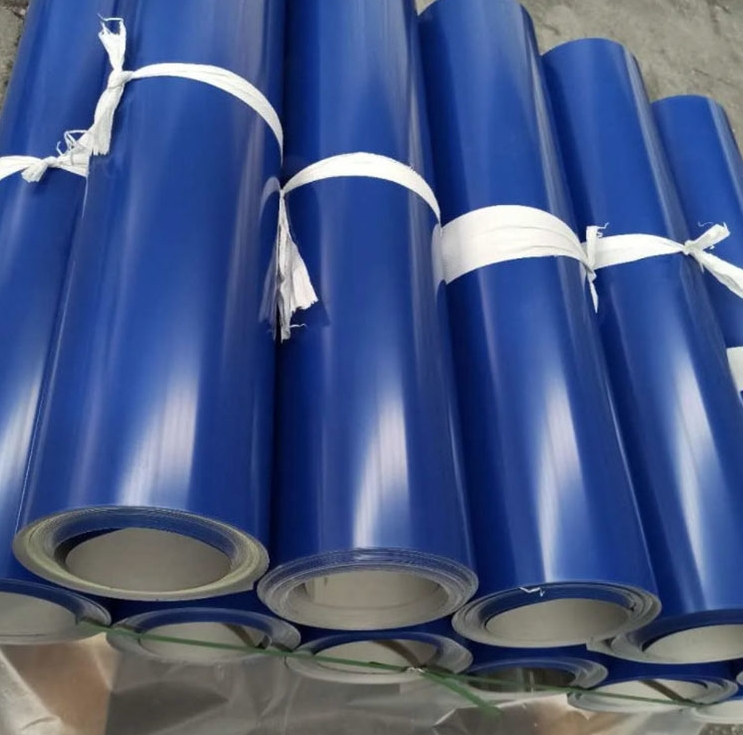

A coated (prepainted) aluminium coil is a continuously coated, factory-applied organic finish on aluminium strip or coil. The aluminium substrate is slit or left full width, treated chemically, and then coil-coated with one or more layers (primer, topcoat, backcoat) in a continuous process before being rewound and shipped. Coil-coating produces uniform thickness, excellent adhesion, and consistent color/finish—attributes demanded by building façade panels, roofing, and appliance skins.

Short paragraph: coil coating is a manufacturing step that converts a metal coil into a durable finished product ready for downstream slitting, masking and fabrication.

Coating systems and why they matter for price

Coating chemistry is the largest single quality and price differentiator for coated aluminium:

-

Polyester (PE / SMP) — lowest cost, used for interior panels, signage, and low-exposure roofing. Lower UV resistance and shorter color warranty.

-

High-performance Polyester / SMP — improved weathering vs basic PE; mid-tier pricing.

-

PVDF (Kynar® / Hylar® / other fluoropolymer systems) — premium product for architectural facades because of superior color retention, chalk resistance and warranties. Adds a significant premium (often several hundred USD/ton) to finished coil price.

-

Fluoropolymer hybrids and novel topcoats — niche premium variants for corrosive environments; pricing is project-specific.

Why this matters: customers specifying long warranties (20+ years color stability) almost always require PVDF or equivalent; that choice typically moves a coated coil from “economy” pricing into the premium band.

Key technical standards and quality checks

Buyers should insist on clear references to standards and lab test reports. The most frequently referenced documents in industry technical specs are:

-

ASTM B209 / B209M — aluminium sheet, coil and plate specification (composition, temper, finish).

-

EN 1396 (coil coated sheet & strip) — European specification defining requirements for coil-coated aluminium for general applications; it describes required testing and coating systems.

-

ECCA (European Coil Coating Association) guidance — coil-coating practice, recommended testing protocols (EN 13523 series referenced by ECCA). ECCA Premium® quality label is used by some suppliers as a quality mark.

Actionable note: request mill certificates (EN 10204 3.1), coating test reports (tape adhesion, cross-cut, salt spray per EN/ISO methods), and PVDF supplier warranty statements as part of any formal RFQ.

How coated-coil prices are constructed

Coated coil = base aluminium metal + coating raw materials & film cost + coating line labour & fixed cost + conversion (slitting, edge trim) + packaging & logistics + margins, duties & premiums.

-

Base metal: LME or regional ingot/primary aluminium price is the foundation. In 2025 the LME reference for aluminium has been trading in the low-to-mid USD 2,000s/t range for much of the year and remains the principal driver for substrate cost.

-

Coating raw materials: PVDF resin, pigments and pretreatments (chromate-free chemical conversion layers) add material costs and require different line speeds—PVDF is markedly more expensive than standard polyester.

-

Processing & scale: High-volume coil coating lines lower per-ton processing cost; small bespoke runs attract a per-ton premium. This is why factory direct suppliers with capacity and stock can offer better ex-works pricing.

-

Trade measures & freight: Tariffs, anti-dumping duties and shipping freight spikes (or container scarcity) can shift delivered prices by hundreds USD/ton. Recent international tariff announcements and global shipping volatility have been an important short-term price factor in 2025.

2025 — global price comparison (representative ranges)

Below is a compact price-range table for coated / prepainted aluminium coil in 2025. These are market ranges intended for procurement benchmarking (sizes assume typical architectural thicknesses 0.4–1.0 mm and minimum orders ~5–20 tonnes). Each range is supported by representative supplier listings, distributor quotes and market signals.

| Region / channel | Typical 2025 price (USD / metric ton) — finished coated coil | Representative source(s) |

|---|---|---|

| China — factory FOB (production runs, polyester & standard PVDF) | USD 1,000 — 2,200 / t | Made-in-China and Chinese supplier FOB listings showing $1,000–1,500 and up to $2,150–2,350/ton for higher spec PVDF. |

| India — domestic suppliers / local coated coil | USD 2,200 — 3,200 / t | TradeIndia and local supplier listings indicating typical pricing bands USD 2,500–3,000/ton for coated coils in 2025. |

| USA — distributors / ex-stock (architectural PVDF premium) | USD 2,700 — 3,800 / t | Distributor catalogues and US service-centres; domestic quoting shows higher premiums due to LME basis + conversion + inventory/distribution costs. |

| European Union — ex-works / ex-stock | USD 2,200 — 3,200 / t | EU suppliers and market research reports—prices reflect European processing costs and EN standard conformity. |

| Global B2B marketplaces / spot FOB (mixed grades) | USD 1,000 — 4,000 / t | Large online listings (Alibaba / Global suppliers) show the full market spread depending on alloy, coating and lot size. Use these only as indicative spot checks. |

How to read the table: the lower end represents economy polyester coatings on 1xxx/3xxx alloys in large lots shipped FOB from China; the upper end reflects thick-film PVDF coatings, premium pigments, architectural warranties and small/express runs. The London Metal Exchange (LME) aluminium price movement remains the biggest elastic element over multi-month purchase cycles.

Procurement tips — what to specify in an RFQ

When asking for quotes, include the following minimum tech & commercial data to get apples-to-apples pricing:

-

Base alloy & temper (e.g., 1100 H24, 3003 H24, 5005 H34).

-

Coating system & thickness (e.g., PVDF 70 μm total film build, or polyester 25 μm).

-

Color & pigment standard (RAL code, metallic effect, custom shade tolerance).

-

Warranties & required test reports (color-fade warranty years; salt spray hours, pencil hardness, cross-cut). Ask for EN/ASTM test certificates.

-

Order size, lead time, slitting width / coil weight.

-

Packing & shipping INCOTERM (FOB/EXW/CIF/DDP).

-

Acceptance inspection method & sampling plan (random coil tests, color meter / ΔE measurement).

Negotiation levers: increase lot size, accept common stock colors, allow factory standard packaging and longer lead times — all reduce supplier unit price. Conversely, very short lead times, bespoke colors, or small lots increase per-ton cost.

Why Luokaiwei (China) can be competitive for coated aluminium coils

(Short, practical selling points you can use in proposals)

-

Factory pricing: direct mill-to-buyer supply reduces distributor mark-ups; when you buy direct from a Chinese coated-coil line like Luokaiwei you typically access lower ex-works or FOB pricing compared with regional distributors.

-

Customization & varnish options: factory lines can run custom PVDF and specialty films on demand; Luokaiwei supports tailored topcoats, thicknesses and slitting widths.

-

Stock & fast delivery: stock coils held in factory warehouses reduce lead time for urgent projects; Luokaiwei’s model emphasizes stock availability for common alloys and colors. (User-provided company positioning.)

-

QC & standards: supply includes mill certificates, coating test reports, and can comply with EN / ASTM test requirements on request.

Practical note for buyers: if your project is export-bound, compare total landed cost (CIF / DDP) — a lower FOB price from China can be offset by freight, duties and local secondary operations; Luokaiwei can provide full landed quotes and coordinate slitting/packaging to minimize local handling.

2025 market drivers and the near-term outlook

-

Primary metal price moves: LME aluminium remains the foundational input. Analysts in 2025 cited both upside risks (supply caps, Chinese smelter policies) and downside risks (global demand slowdown). Expect base metal volatility to remain the dominant price swing factor.

-

Tariffs & trade policy: tariff announcements can change regional competitiveness quickly (examples in 2025 show renewed tariff activity affecting aluminium/steel flows). Buyers should build tariff sensitivity into scenario pricing.

-

Coating raw material availability & pigment costs: specialty resins (PVDF) and high-quality pigments are subject to supply chain tightness; shortages raise premiums for architectural grades.

-

Logistics & container freight: shipping cost reductions will lower landed prices, while spikes will penalize smaller orders more heavily. Monitor freight indices when planning months-ahead purchases.

Practical forecast: unless LME collapses or global demand plunges, premium PVDF architectural coated coils will likely keep a positive spread over standard polyester products through 2025–2026 due to warranty demand and limited coating line capacity for the highest-end systems.

FAQs

Q1 — How much extra should I budget for PVDF vs polyester?

A1 — Expect PVDF to add anywhere from USD 200–700/ton on top of a polyester coated coil, depending on film thickness, pigment and warranty terms. For architectural color stability and long warranties choose PVDF; for low-exposure uses polyester is normally adequate.

Q2 — Is buy-direct from China always cheaper than local distributors?

A2 — Not always. Factory FOB prices are often lower, but landed cost (freight, duties, inland trucking, local processing) can close the gap. For large lots (20+ t) and standard colors, Chinese factory direct usually gives the best total cost. Use full landed quotes for comparison.

Q3 — What documents should I require before shipment?

A3 — Minimum: mill certificate (EN 10204 3.1), coating test reports (cross-cut, adhesion, salt spray), color sample / ΔE report, packing list and original commercial invoice. For architecture projects also request PVDF supplier warranty wording.

Q4 — Can coated aluminium coil be recoated or repainted in the field?

A4 — Yes, recoating is possible but depends on substrate preparation, existing film and environmental exposure. Recoating is usually more expensive and less durable than specifying the correct film at origin. For long life, pick the correct factory coating.

Q5 — How to validate color & gloss for a large project?

A5 — Use a certified color meter (spectrophotometer) and define ΔE tolerances in the contract. Request production samples from the same coil lot and a pre-shipment color check at the coater. Insist on lot traceability and a hold back sample for any on-site verification.

Quick checklist for a strong RFQ (copy / paste)

-

Alloy & temper (e.g., 3003 H24)

-

Coating system & total film build (e.g., PVDF 70 μm)

-

Color (RAL), gloss % and ΔE tolerance

-

Coil width, ID/OD, coil weight range and slit requirements

-

Test & certificate list (EN/ASTM tests, 3.1 mill cert)

-

Warranty expectations (years) and region of service (coastal? industrial?)

-

INCOTERM and delivery port / final destination

-

Target order size and expected repeat cadence

If you need consistent architectural performance (PVDF 20+ year color warranty) source coated coils from proven suppliers who can show EN/AST6-type test reports and who can provide sample panels from the same production lot. For cost-conscious volume orders where color longevity is less critical, Chinese factory stock and standard polyester systems can deliver the best USD/ton value — Luokaiwei, as a Chinese manufacturer with factory lines and stock management, can offer both competitive ex-works pricing and fast turnarounds for standard colors and slitting configurations.