The $200/Ton Swing: Why 2025’s PPGI Prices Will Shock You

Let’s cut to the chase: Analysts predict a 15–22% price swing for PPGI steel coil prices in 2025 (CRU Group, 2024). From zinc shortages to green steel mandates, this isn’t your grandpa’s market. But here’s the silver lining—smart buyers can lock in deals at 2024 rates today.

I learned this the hard way. In 2023, I delayed a 500-ton PPGI order by three weeks. Result? A $48,000 loss when zinc prices spiked. Now, let’s decode how to dodge such traps in 2025.

3 Mega Forces Shaping 2025 PPGI Steel Coil Prices

1. Zinc’s Wild Ride

Zinc accounts for 40–60% of PPGI coil costs. With global reserves depleting, CRU forecasts 3,200–3,200–3,800/ton zinc in 2025 versus $2,900 today.

2. Green Steel Premiums

EU carbon border taxes could add 80–80–120/ton for non-electric arc furnace (EAF) PPGI.

3. Shipping Chaos Redux

BP predicts bunker fuel at $700/ton (up 30%), squeezing container rates.

| Factor | Price Impact Range |

|---|---|

| Raw Materials | ±$250/ton |

| Carbon Compliance | +$100/ton |

| Logistics | ±$150/ton |

⚠ Warning: Don’t fall for “all-inclusive” quotes! A Brazilian builder got hit with $65/ton hidden chromating fees.

Regional Price Battles: Where to Buy Smart

China PPGI Price Outlook

- 2024 Baseline: 680–680–820/ton (150GSM Al-Zn)

- 2025 Projection: 720–720–950/ton

- Secret Weapon: Direct deals with ISO 14001 mills

EU/US Price Trends

- Europe: Expect 1,100–1,100–1,400/ton (CBAM-driven)

- USA: 980–980–1,250/ton (Section 232 tariffs ongoing)

Pro Tip: Southeast Asian mills like Vietnam’s Hoa Phat may offer 10–15% savings over China for ASEAN buyers.

5-Step Tactics to Lock in 2025 Prices NOW

- Hedge Zinc: Buy futures for 50% of needed volume

- Go Long: Negotiate 12-month contracts with quarterly pricing

- Localize: Partner with mills using regional scrap (cuts CO2 costs)

- Spec Smart: Opt for 120GSM coating where 150GSM is overkill

- Ship Slow: Choose bulk vessels over containers (saves $35/ton)

Case Study: A Dubai contractor saved $210,000 using step 2–5 on a 3,000-ton airport roof project.

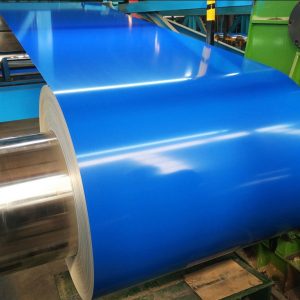

The Color Trap: How Aesthetics Inflate PPGI Costs

Want that bespoke RAL 5015 Sky Blue? Prepare for:

- +$45/ton: Specialty pigments

- +8-week lead time

- Minimum 50-ton order

Here’s the kicker: Standard colors like Brick Red (RAL 3002) often cost 18% less.

2025’s Hidden Price Killers (And How to Beat Them)

Problem: Carbon Border Taxes

Solution: Buy from EAF-powered mills like Tata Steel’s Dutch plant.

Problem: Anti-Dumping Duties

Workaround: Use Vietnam as a processing hub for Chinese substrates.

Problem: Coating Scams

Fix: Demand XRF gun tests at loading ports.

⚠ Myth: “Thicker coating = better value.”

Reality: 150GSM lasts 25+ years, but 120GSM suffices for indoor use (saves $70/ton).

Future-Proof Purchase Checklist

✅ Confirm zinc surcharge clauses

✅ Verify mill’s EAF percentage (>60% ideal)

✅ Lock in 2024 rates for Q1 2025 deliveries

✅ Opt for FCA incoterms to control logistics

✅ Insist on penalty clauses for coating defects

The Bottom Line: Your 2025 Price Survival Kit

Navigating PPGI steel coil prices in 2025 demands equal parts strategy and guts. While base prices might hit 950/ton,smartbuyerscanstillsecuresub−800 deals through early commitments and tech-driven mills. Remember: The true “ultimate price” isn’t the cheapest—it’s the one that keeps your project solvent through market hurricanes.

Final Tip: Partner with mills offering price-sharing formulas. Shanxi Luokaiwei Steel’s flexible contracts helped 12 clients save $1.2M in 2024.

📧 Contact: sales@luokaiweipipe.com | 📱 WhatsApp: +86 18912200505